Many Canadians may have challenges saving money for retirement due to the different situations and …

Do you wish to determine whether your Canadian Airbnb income is taxable or not? Have …

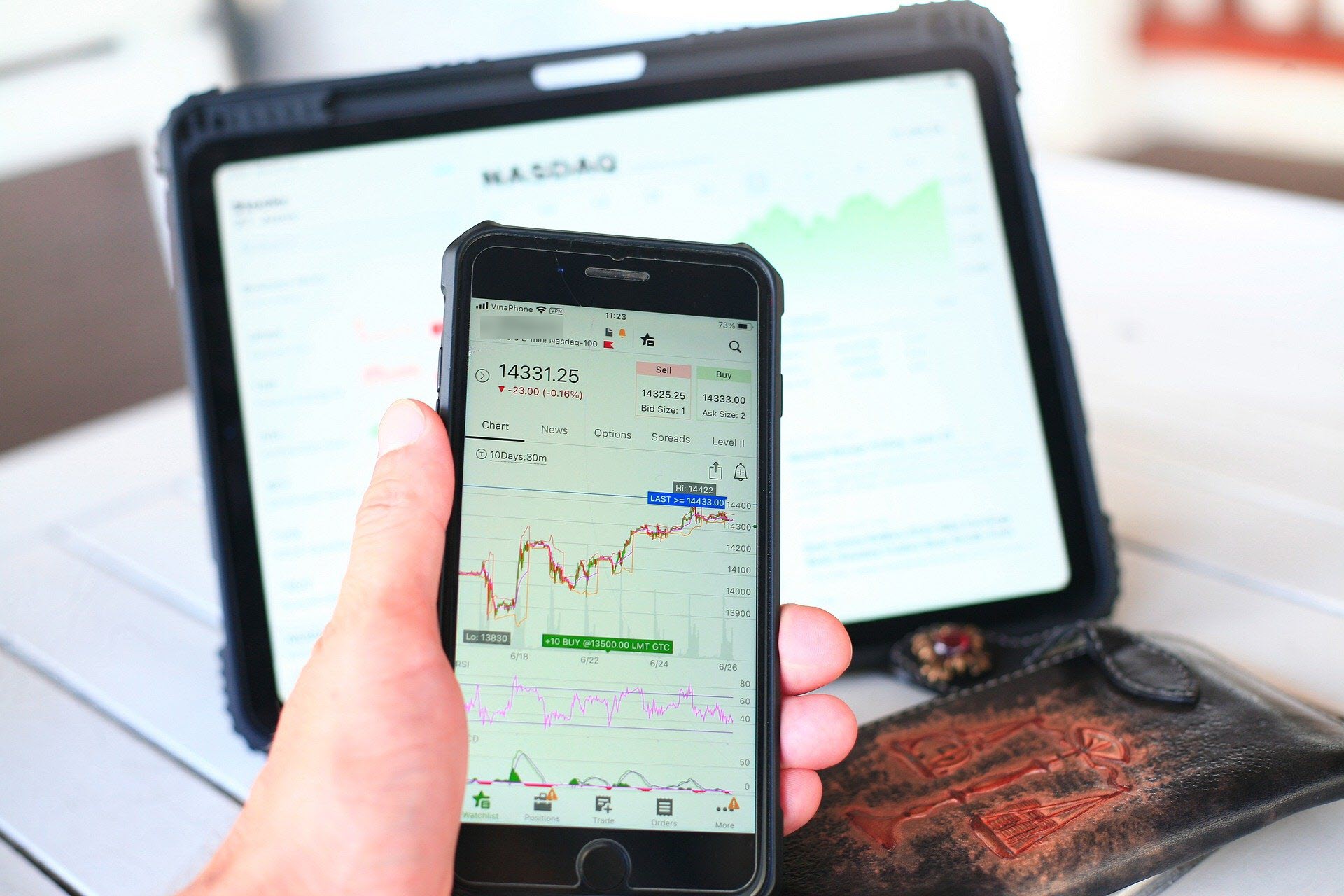

What is a stock option? Stock options are a financial tool that permits the option …

As a shareholder of an incorporated business you should consider the possibility of issuing shareholder …

Let’s face it! We all want to pay fewer taxes. The first step always is …

As there is a notable shift in the world due to digital technology forces, the …

Buying a dental practice is a very stressful and time-consuming process. It can be a …

It is important for Canadian doctors to have a plan in place for their taxes …

New tax rules were implemented in 2019 by the Government of Canada regarding investment income …

Self-Employed Taxes in Ontario Being self-employed as a sole-proprietor or part of a partnership would …

A Tax-Free Savings Account (“TFSA”) is an account used for the purposes of holding registered …

One of the questions I get a lot from my clients is when should I …

As a business owner, you care about two things and two things only, that’s increasing …

Should you lease or buy a car? Many people will justify purchasing a more expensive …

Two of the most common mistakes I see many doctors make is either not deducting …

It is credible to state that several physicians prefer to obtain life insurance through Medicine …

It is credible to state that a large portion of Ontario-residents are unaware of the …

This is the latest in our “Ask SRJ” series, where we answer questions to topics …

Recent Posts

What are the Articles of Incorporation? How to pay the Canada Revenue Agency (CRA) Canadian Tax – Personal Tax Deadline 2025 How to Determine Your Company's Fiscal Year The Requirements for Sales Tax in Canada when Selling Goods or ServicesCategories

Accounting FirmBusiness ValuationCFOCloud Accounting and BookkeepingCorporate TaxCryptocurrencyGST/HSTInternational TaxNews and Tax UpdatesNRC IRAPPayrollPersonal AccountingPersonal TaxProfessional CorporationPsychotherapy TaxReal EstateReal Estate Investor TaxRetail AccountingSales TaxSmall BusinessSR&EDStartups GuideTax Tips